Are tax rates going up in 2026?

That’s a great question. As the AICPA put it in February 13th’s Town Hall session, there’s a “long winding road” ahead of us as budgets, reconciliations, and tax packages battle their way through Congress.

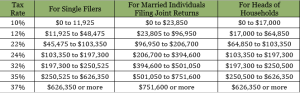

What we do know is that for 2025, the tax brackets look like this:

Since the passing of the Tax Cuts and Jobs Act, we have consulted with clients on opportunities to convert IRA accounts to Roth IRAs while staying within the 12% to 24% tax brackets. There are many factors to consider when creating Roth conversion strategies, so it is not a one-size-fits-all opportunity.

The idea behind a Roth conversion is to transfer tax-deferred assets from a traditional retirement account (e.g., a traditional IRA or 401(k)) into a Roth IRA. Roth IRAs currently have no required minimum distribution requirements, and distributions are not subject to income tax. This allows for tax-free growth on Roth assets. However, converting a tax-deferred account to a Roth IRA generates taxable income in the year of conversion, meaning the taxpayer must pay taxes on the total amount converted.

Here are a couple of scenarios where we have identified meaningful opportunities for Roth conversions:

When taxpayers retire in their early 60s, they often experience a temporary drop in ordinary income (e.g., wages, self-employment income). Without wages or other earned income, and before required retirement distributions or Social Security begin, their taxable income is significantly lower. They may still have interest and dividend income from taxable brokerage accounts, but with larger standard deductions, the first $30,000 for married taxpayers ($15,000 for single taxpayers) is essentially non-taxable.

This creates a window of opportunity for Roth conversions at lower tax rates. Even if their interest and dividend income exceeds the standard deduction by two or three times, there is still room within the lower tax brackets to consider a Roth conversion. We have worked with clients to project the maximum Roth conversion amount they can absorb while remaining in the 22% or 24% tax brackets, depending on their preferences and tolerance for certain tax rates.

Clients often hear me say, “I am never going to tell you to give money away just to save taxes.” However, if there is already a desire and a plan for charitable contributions, we aim to make those gifts as tax-efficient as possible. Pairing a Roth conversion with a large charitable donation can essentially offset the tax liability on the conversion.

One client called me to share that she wanted to donate $50,000 to a charitable organization dear to her. Because our collaborative relationship included working with her investment advisor, I was aware that her financial plan factored in a desire to hold Roth assets. We modeled a scenario showing that she could convert $50,000 to her Roth IRA in the same year she made the $50,000 gift. As a result, her annual tax liability remained essentially neutral, allowing her to use the charitable donation to offset the taxes on the Roth conversion.

In another case, a recently retired client informed us that he and his wife planned to donate $100,000 of stock to his university. The deductibility of stock gifts is limited to 30% of adjusted gross income (AGI), with a five-year carryover. To deduct the $100,000 stock gift in full, they needed at least $300,000 of taxable income. However, since he had recently retired, his taxable income was significantly lower than that.

Working alongside the client’s investment advisor, we developed a strategy to use Roth conversions to increase their taxable income, allowing them to fully deduct the charitable gift in the same year. Ultimately, the client decided to convert $400,000 to a Roth IRA, which more than covered the required income level for full deductibility. He chose to max out the 24% tax bracket, believing it was a favorable rate to pay in exchange for tax-free growth on the $400,000 conversion.

There are additional considerations in Roth conversion strategies, such as monitoring overall AGI levels to avoid Medicare premium surcharges (IRMAA) and incorporating estate planning objectives. We are here to provide the expertise and guidance needed to navigate these strategies effectively.